The International Monetary Fund recently concluded an Article IV visit to South Africa. The IMF normally conducts such visits with member countries on an annual basis. The IMF consultation was concluded on November 2019 and was followed by an Article IV statement and report published on 30 January 2020. View the complete press release, IMF staff report and executive statement here.

The statement is noteworthy especially for its presentation of the local economy and the reforms the IMF thinks are required to turn SA’s economy around. The report provides us with a glimpse into ‘IMF thinking’ as it were. Should SA’s government ever decide to approach the IMF for any balance of payment loans or financial assistance for structural adjustment, it is likely that the IMF’s current “encouragements” in the report could quickly turn into loan conditions. (Whether the ANC will ever approach the IMF, before exhausting a number of other damaging options, such as ‘prescribed assets’, is an open question.)

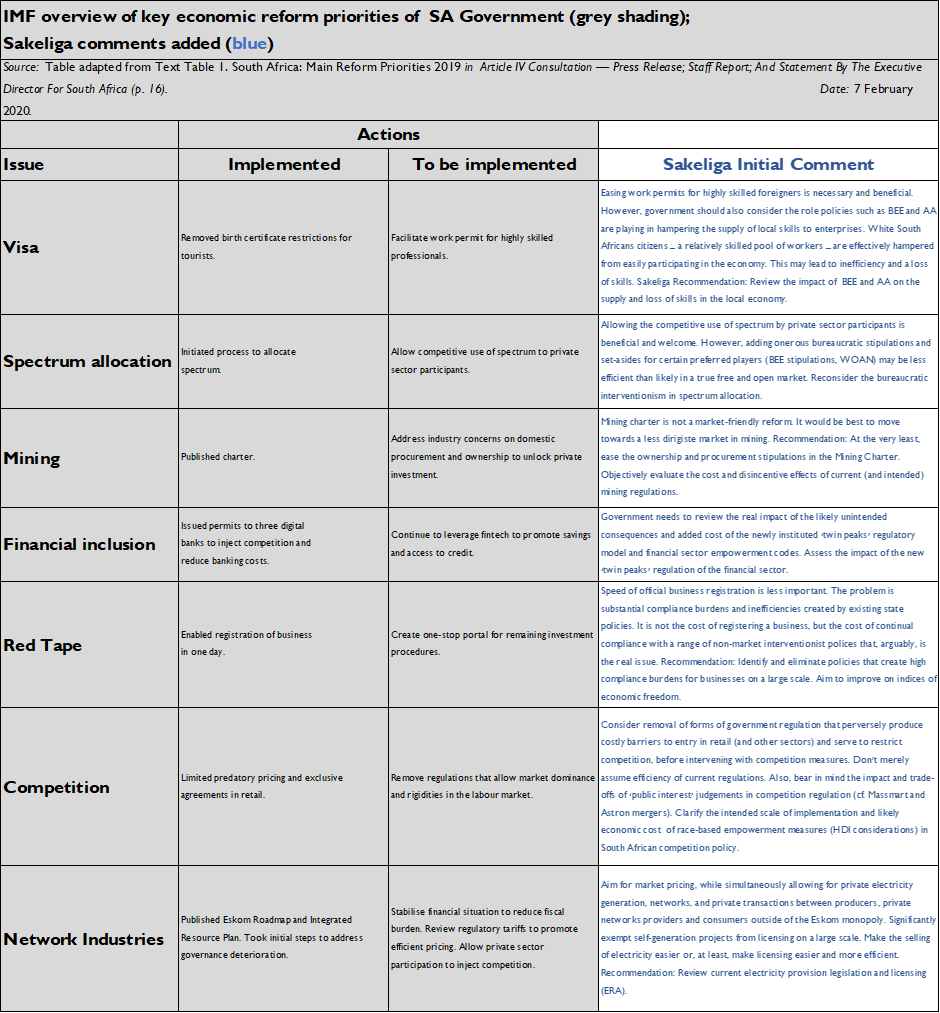

For the purpose of this discussion, the focus will fall on the IMF’s perspective on the SA government’s economic policy. We focus on some suggestions on economic reforms made by the IMF. We’ll colour in those suggestions with some of our own considerations. Lastly, we’ll conclude with comments on the reform priorities currently being emphasized by government itself (see the table below). Given the IMF’s assessment and our considerations, we don’t think that the government’s current reform efforts go far enough.

The nub of the IMF’s statement

The nub of the IMF’s executive board’s recent statement appears to be an “encouragement” for government to “[…] implement strong fiscal consolidation and SOE reforms to ensure debt sustainability, accompanied by decisive structural reform measures to boost private sector-led, inclusive growth” [emphasis added].

Fiscal considerations

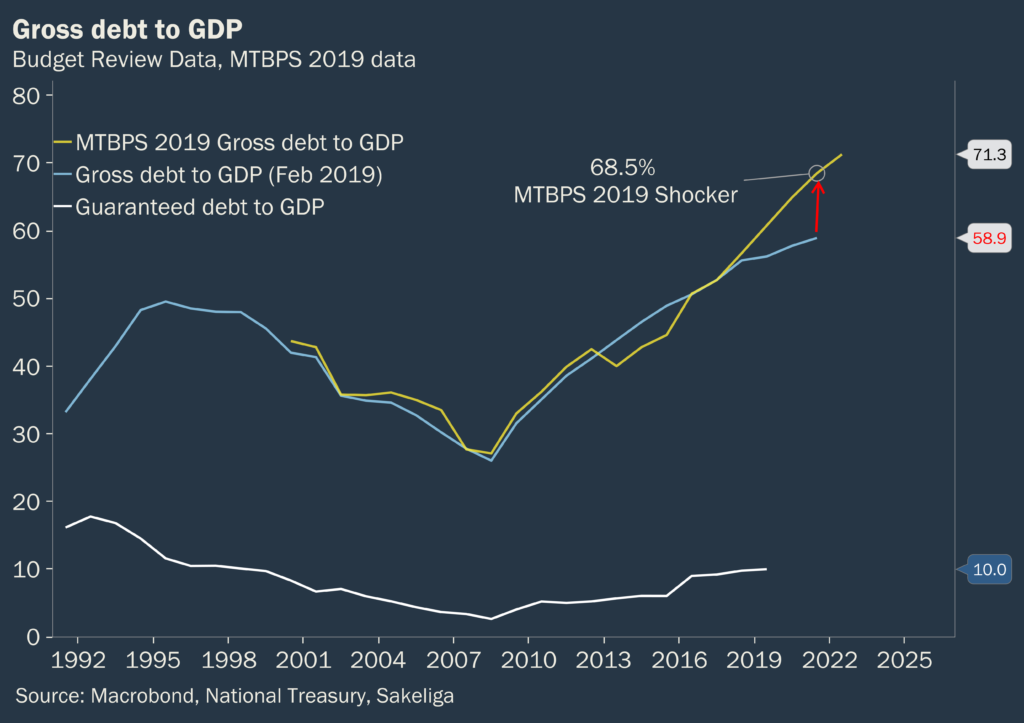

The statement was made under conditions of severe pressure on government’s budget. This was only too evident in the October 2019 MTBPS debt shocker, where we saw a staggering worsening in the debt-to-GDP outlook over the medium term.

Emphasis on the need to get state finances under control, all things considered, is not really a surprise. Fiscal deterioration has been in the works for some years. The IMF’s encouragement to “maintain medium-term debt sustainability” is certainly reasonable.

The IMF’s fiscal recommendations to government include anchoring the government debt at sustainable levels, reducing public wages, avoiding further “fiscal surprises” from state-owned enterprises (SOEs) and increasing the efficiency of public spending. SOEs, according to the IMF, must be made more lean, efficient and competitive.

These certainly are good ideas. The main hurdles unfortunately do not lie in the analysis of the problem, but in the execution of solutions in an economy hampered by politics.

Tax measures were also suggested. These appear in line with the mixed-economy philosophy of the IMF and place an emphasis on sounder tax administration and limiting so-called “base erosion” and “profit shifting”.

The report also holds that “Given the key role of expenditure in deficit increases, the relatively robust tax-to-GDP ratio, the uncertain yields of tax measures in a weak economy, and the largely revenue-based efforts to consolidate in recent years, an expenditure-based adjustment is recommended.”

This is a technical way of telling government to cut spending now and not to increase taxes.

Assessment of “Structural Reforms”

What is perhaps more important to consider are the IMF’s ideas on structural policy reforms. Many of these reforms, though perhaps not all of them, are in line with our thoughts on reform. At the core of their “encouragements” are calls for structural reforms that “reduce the cost of doing business and boost private investment”.

Moreover, in order to spur on investment, the IMF advises government to “reduc[e] confidence-sapping policy announcements”, such as on expropriation. The report clarifies this point by explaining that “[t]he policy [of expropriation without compensation], however, raises property rights issues among present and prospective landowners.”

In the context of structural reforms, the IMF report mentions the need to improve competition in consumer (product) markets. It also criticizes elements of current labour legislation and industrial policy. The IMF also regards “restrictive procurement” and “labour regulations” as severe impediments to the economy.

The emphasis on the nature of regulations is important to consider. Some local commentators seem to focus exclusively on issues of ‘policy uncertainty’ without taking into consideration the form of government’s economic policies.

For instance, the ANC government may be happy to address “concentration” through competition measures, which would be in line with the IMF report’s suggestions and practices in other legal jurisdictions. It should be considered, however, that the precise form policy measures take could differ from other jurisdictions – and could be more or less damaging to the functioning of a market economy.

Competition

In its report, the IMF has called for a consideration of “distortive regulations” in product markets and for measures to “boost competition”. We would agree with such a recommendation. Regulations and ensuing compliance requirements (costs) often create the exact hurdles that serve as barriers to small entrants who cannot afford high compliance costs/requirements in legal compliance.

Curiously though, the IMF appears uninformed about the recent developments in the application of local competition policy with ‘public interest’ and ‘HDI empowerment’ stipulations. This is important because it speaks to the type of competition measures we can expect to see. For example, in one competition case, a merger was only approved upon the condition that the acquiring firm (Astron) set up a R220 million empowerment fund. This was done in line with so-called ‘public interest’ considerations. Such interventions in the market, we would argue, are not exactly moving in the direction of freer markets or non-interventionism. At the very least, they could undoubtedly dissuade some investment in South Africa by making mergers more expensive.

Labour market reforms

The report mentions the need for labour market reforms and calls for more “flexibility” in labour markets. It regards as problematic the current application of centralised wage bargaining. Labour market flexibility, the IMF argued in a previous report, can be increased by reviewing centralised bargaining. The report adds, “wage bargaining needs to be decentralized and workforce management restrictions relaxed so that hiring decisions are aligned with business needs.” To that end, it would also require a reconsideration of the extension of collective agreements.

Private sector participation

The report also calls for private sector participation in network industries, such as electricity provision. Sakeliga regularly calls for a review of electricity regulation (ERA) to the end of allowing greater private sector electricity provision.

Industrial Policy

The IMF also took local industrial policy to task by saying that “[m]ore generally, the industrial policy in place should switch from providing subsidies and tax breaks to selected sectors to facilitating favourable business conditions to attract any firms that can compete in global markets.”

That is correct in our estimation. Government, through industrial policy, is acting too much like an entrepreneur, seeking to identify and support certain sectors as part of an industrial strategy. While such policies are common in many countries, we would argue that subsidizing particular sectors and levying import taxes is problematic from a free markets perspective. Economic policy, in our view, should rather focus on easing, broadly, the impediments and hurdles to commerce.

Empowerment

Interestingly, the IMF report notes that “The authorities [SA Government] acknowledged the inherent efficiency-equity trade-off arising from regulatory requirements aimed at broadening citizens’ participation in the economy and supporting the emergence of industries through localization.” This, of course, refers to BEE and localization policies. The supposed admission of an efficiency for equity trade-off by government is welcome. If government, in fact, acknowledges inherent trade-offs, a logical next step should be to ask whether the losses (costs) aren’t in fact greater than the actual benefits.

Government’s current reform efforts

The IMF report also outlines, in a table, the main current reform priorities presented by the South African government itself. These are, as it were, government’s own aims for policy reform. We have reproduced the table below, which is presented with some further comments on policy reform in the last column.

Our recommendations will appear market-friendly, and, likely, politically hard to implement at this stage. We hope to present, however, a counterbalance to the current highly interventionist continuum of policy in South Africa. At the very least, our recommendations would point in the direction reforms would have to take in order to be considered more free market-friendly.