Author: Jana van Deventer, ETM Analytics

Moody’s held its Sub-Saharan Africa Annual Summit in Johannesburg on Tuesday, 10 September. Compared to the S&P conference that was held earlier this year in April, attendance was relatively lower. The event failed to deliver any substantially new information regarding the state of the South African economy, yet it did provide a glimpse into Moody’s view on the country as well as risks on the rating front going forward.

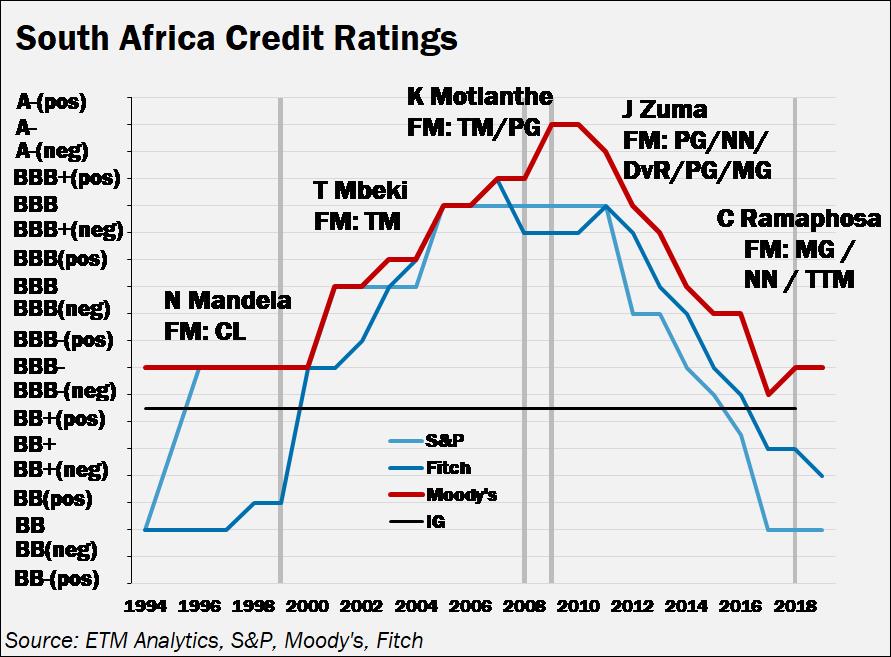

On balance, while Moody’s seems to be behind the credit rating curve, an eventual downgrade to sub-investment grade status still seems inevitable, unless the government can gain momentum on implementing economic policy reform.

Past performance suggests that this is highly unlikely, though, and ETM Analytics’ view therefore remains that it will be difficult for South Africa to avoid slipping into junk status.

Deteriorating global environment compounding risks to the local growth outlook

Scripted topics focused on factors such as the increase in major developed market bond yields, which now offer negative returns as well as mounting risks for the global economy. Moreover, growth, financial stability and political risks were the three major threats that Moody’s flagged in terms of emerging market vulnerabilities. On the flip side, Moody’s identified trade, demographics, tech and ESG (environment, social and governance) as potential changing drivers of success. Speakers placed quite a bit of emphasis on the ESG aspect across all the different sessions covered on the day, and these metrics will hold added focus when assessing countries and corporates’ ratings in the future.

The session that focused on the sovereign rating confirmed what many already know, namely that the economy remains under pressure and growth potential is being hampered by structural bottlenecks including weak productivity, low gross fixed capital formation, subdued sentiment and constraints to the reform process. Moody’s pegged GDP forecasts for 2019 and 2020 at 0.7% and 1.5%, respectively, which means that growth is expected to accelerate in the coming quarters when considering that GDP only expanded about 0.4% y/y in H1. It is not clear what the rise in expected growth is attributed to, and the risks to these estimates are no doubt skewed to the downside given mounting pressure from a mature and tiring global business cycle.

It’s all about the fiscus and debt sustainability

Eskom featured prominently. The latest bailout is considered a short-term solution to the entity’s vast range of problems and the government still has a mammoth task ahead to restructure the parastatal to ensure both operational and financial (including debt) sustainability. Questions around Moody’s view on the use of prescribed assets as a means of tapping pension funds to bail out Eskom went unanswered. It appears as though the Moody’s stance on the issue is that details surrounding what this might look like are insufficient to draw any concrete conclusions on what it might mean for the country’s credit rating. Ultimately, their response will likely be reactionary.

They focused on overall fiscal expenditure, and their stance created the impression that the agency is sympathetic towards government and the constraints it faces, especially in the context of the government’s redistributive role. It is clear that the agency still has some faith in the Ramaphosa administration, which Moody’s touted as being “very reform orientated”, albeit that they emphasised numerous times that the agency remains sceptical about government’s ability to implement much-needed growth reforms.

In terms of the revenue dynamics, mention was made of pressure stemming from chronically subdued growth. Perhaps more notable was the response to a question regarding whether the credit rating agency has investigated how skilled emigration might be structurally suppressing tax intake. Anecdotal evidence suggests that highly skilled individuals are seeking greener pastures abroad and such a trend risks further eroding an already stretched tax base. Moody’s indicated that they would be looking into the makeup of the tax intake and potential loopholes in the system, adding that they would need to monitor the emigration data to get a clear handle on how it might impact the tax base.

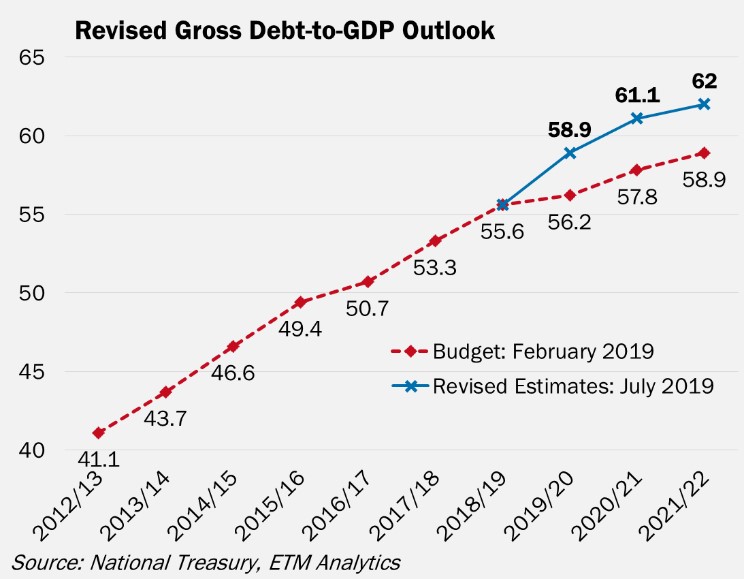

Shifting focus to debt servicing costs, this seems to be the component which is generating a fair amount of concern for a good reason. Failure to contain the debt servicing component is a major risk for South Africa. An additional widening in the country’s risk premium or further deterioration in investor confidence, for example, could commensurately increase the debt servicing burden through a rise in interest rates. The agency is closely monitoring the country’s debt burden sensitivity and policymakers’ credibility as well as ability to respond.

It is instructive that while concern remains over the debt burden, Moody’s did highlight the structure of the country’s debt as a supporting factor. This view hinges on a) the maturity profile of the country’s debt profile, b) how the bulk of the government’s debt is rand-denominated and c) the government’s limited exposure to FX risks despite the large proportion of foreign ownership of domestic bonds. The latter nevertheless highlights South Africa’s heightened vulnerability to global financial market volatility.

The conference offered no clarity regarding the potential timing of a downgrade, however, given the deterioration in the fiscal dynamics and the rapidly steepening debt/GDP trajectory, there is a genuine risk that the outlook is lowered from stable to negative when the November review gets published. It is imperative that the government rapidly starts implementing growth reforms that address South Africa’s structural bottlenecks to bolster the medium-term growth potential.

Moreover, measures need to be taken to stabilise the total debt/GDP ratio and such actions, in our view, would need to include workable turnaround plans for state-owned entities.

Conclusion

While the market discounted domestic assets to reflect sub-investment grade status some time ago, as reflected in the hefty risk premium on government bonds and elevated spreads on South Africa’s credit default swaps, there will nevertheless be ramifications for the economy as well as investor sentiment should Moody’s ultimately downgrade the debt rating. It seems as though Moody’s is backwards-looking in its assessment of underlying fundamentals, especially concerning fiscal and economic metrics, which would naturally result in their credit analysis being behind the curve. The most pertinent risk would perhaps be for corporates, whose credit ratings tend to get adjusted in lockstep with the sovereign. Sub-investment grade status for South African corporates would not only underpin the cost of debt but also stifle these corporates’ access to capital. Corporate South Africa is already under tremendous pressure, and hence any additional headwinds would further squeeze already tight margins, which would risk additional layoffs.